Investment Group

The WBB Investments Group is “Broker of Record” for an internationally recognized and award winning boutique operating in the three core sectors of Infrastructure Development, Project Advisory and International Trade. Our core expertise are in project origination, establishing trade routes and providing predominantly sell-side advisory to ensure projects are bankable, across the emerging markets in regions such as Africa, LATAM and Asia; acting as the parent company and execution arm of WBB of Companies. Via the holdings of the group, WBB is able to provide all the necessary services for any infrastructure or trade project, including project financing, structuring, advisory, EPC services, as well as negotiating important off-take agreements through its trade desk. All whilst bridging the cultural and corporate gap through its teams strategically located across the globe in key hubs such as London, Istanbul, Seoul, Zug, Kinshasa, Luanda, Lagos and Milan. We deploy our project advisory and trade expertise to originate and enhance the development of real assets, impactful infrastructure, and natural resources and are to date outperforming our rivals through distinct strategies. We have emerged as one of the great, idiosyncratic talents of the twenty-first century. In addition, Opulent has sister companies specializing in Structured Finance, Steel, and Real Estate Infrastructure; With main headquarters in London and Istanbul and Satellite offices strategically positioned across Emerging Markets globally, ensuring our corporate strategy focuses on the three pillars of ESG and Sustainability throughout our global operations; enabling our strengths to lay in decoding complicated ESG macro-trends into actionable insights. Unmatched on a global scale, Opulent has strategically cultivated best-in-class partnerships worldwide across an array of sectors and calls upon and leverages the resources and networks of its parent and sister companies, acquiring the ability to provide each client with a service and reach beyond what most conventional firms are able to accomplish. A strong and powerful network yields enduring results that last for years to come

WBB closely collaborates with project owners to create and design a tailor made project structure that fulfills the criteria for a bankable project, which is highly sought after in the world’s markets. We work hand in hand with various organizations to originate and realize impactful infrastructure, including buildings, roads, power supply, ports, and water treatment, that are essential for the operation and development of a country or economy. We are also actively involved in the implementation of crucial infrastructure projects related to natural resources.

WBB unique methodology for providing bespoke advisory and strategic consultation has enabled us to cater to major

global corporations and market makers worldwide across a variety of industries. This includes supporting Emerging Market

Infrastructure Project Owners in achieving and realizing their project goals, developing trade execution strategies for

leading Swiss commodity trade houses, and providing guidance to international leaders in steel production, mining

companies, and SOEs.

Opulent has acquired a high level of expertise in bridging the gap between producers and end users by implementing effective strategies. Our physical presence in major commodity hubs like London, Zug, and Istanbul allows us to leverage top service providers and establish a robust banking, logistical, and trade infrastructure to facilitate and execute seamless trading. We extend our proficiency in this area to provide advisory to mining companies across Africa and South America, including arranging and negotiating crucial off-take agreements.

Opulent established its Mergers and Acquisitions division during a time of turmoil in the global markets, as the first quarter of 2023 saw a sharp decline in global M&A activity due to increasing interest rates, high inflation, and concerns of an impending recession. Despite this challenging environment, our division leverages strategic partnerships to bridge the gap between chaos and opportunity. With the support of our global network, we are able to identify and fill any gaps in our transactions efficiently, ensuring timely completion.

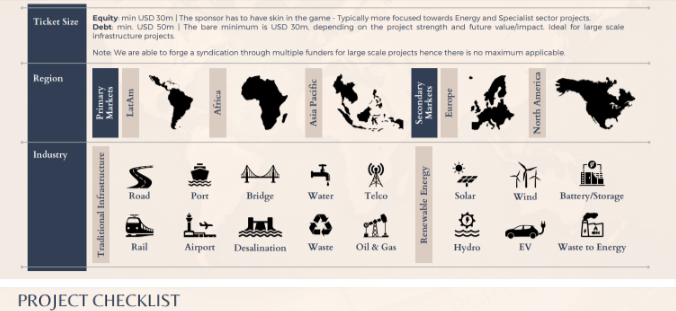

OUR APPETITE – PROJECT CRITERIA

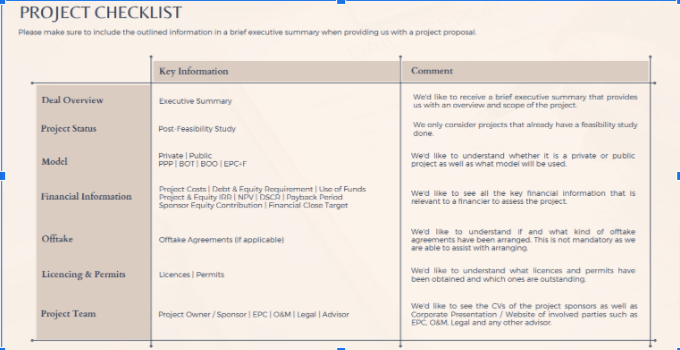

Our primary and core focus in Emerging Markets is to help project owners bring their visions to life. To achieve this, we work closely with our financial partners, such as banks, institutions, alternative lenders, and investors, making sure each transaction and project meets their investment appetite and criteria. Being flexible and adaptable is a key ingredient when dealing in those markets which is why our checklist is not set in stone. We are able to handle projects of various sizes and industries given our strong distribution to over 200+ international and alternative funders both in the private and public capital markets. Our preference and core focus is on structuring projects in the emerging markets, bringing them to a bankable stage so that debt solutions can be seamlessly obtained and implemented to bring the projects to manifestation.

CONTACT US

We acknowledge the importance of your funding needs and extend our services beyond mere financing. Our comprehensive approach covers the entire lifecycle and ecosystem of infrastructure projects, spanning from project structuring to addressing your off-take requirements, financing, procurement, and hedging solutions. Our committed team is devoted to enhancing the bankability of your projects, ensuring their successful realization. We invite you to connect with us today to explore how we can provide unwavering support for your endeavors, facilitating the realization and manifestation of your projects.

DISCLAIMER

The information provided in this document is for general informational purposes only and should not be considered as financial or investment advice. Our company is engaged in bespoke project advisory within infrastructure, and the content of our presentation is not intended to constitute any form of solicitation, recommendation, or endorsement of any specific strategy. Investing in infrastructure involves a level of risk. The services and activities described may not be suitable for all individuals or organizations, and we strongly recommend seeking professional advice as well as carefully considering your risk tolerance before making any business decisions. This profile and its attachments, if any, are strictly confidential and may contain privileged information. They are intended solely for the use of the individual or entity to whom it is addressed. If you are not the intended recipient, please notify the sender immediately by email. Any unauthorized use, disclosure, copying, or distribution of this email or its contents is strictly prohibited and may be unlawful. All rights reserved. Our company strictly operates with corporate email addresses. We do not accept any liability or losses if you engage with anyone that is not associated with our company. If you receive any email or communication from anyone claiming to represent or work for us and have any doubts, then please reach out to our legal team at contact@webrokerbiz.com. The information on our presentation may not be up-to-date, and it is subject to change without notice. By accessing and using our profile, you acknowledge and agree to the terms of this disclaimer.